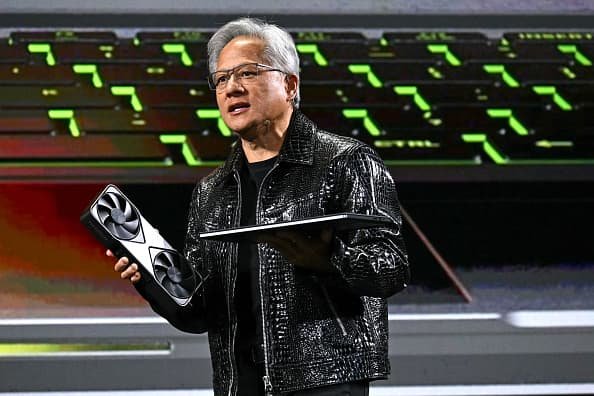

Wall Street managed to end a terrible week of trading with a rally. The absence of the near-daily barrage of tariff headlines from President Donald Trump helped the market Friday ahead of an important week for investors. U.S. stocks did, however, decline for the week, which saw the Nasdaq remain in correction territory and the S & P 500 dip in and out of correction. All the while, the S & P Short Range Oscillator , our trusted momentum indicator, spent most of the week slipping further and further into oversold territory. Per our discipline, we took advantage of the declines to buy more shares of the companies we believe in for the long haul. At the same time, we also opportunistically trimmed some outperforming stocks to bolster our cash position. Trade recap: March 10-14 Monday Bought 25 shares of CrowdStrike Trimmed 75 shares of Abbott Labs; sold 10 shares of Linde; bought 10 shares of Goldman Sachs Bought 50 shares of Capital One Financial Bought 50 shares of Disney Tuesday Bought 50 shares of Capital One Sold 75 shares of GE Healthcare; bought 50 shares of TJX Companies; bought 50 shares of Texas Roadhouse Wednesday Bought 50 shares of Texas Roadhouse Bought 30 shares of Dover Thursday Bought 50 shares of Capital One Bought 25 shares of Eaton Bought 15 shares of Home Depot Friday Exited Nextracker; bought 50 shares of Capital One After Friday’s close, the market was still oversold but not by as much. For the week, the S & P 500 lost 2.3% and the tech-heavy Nasdaq lost 2.4%. The two indexes have each declined for four straight weeks. The Dow lost 3% last week — its worst weekly decline since March 2023. The 30-stock average also finished lower in the prior week. Trump and Treasury Secretary Scott Bessent downplayed the significance of Wall Street’s swoon, saying last week that the greater need to remake the economy was worth some market volatility. Investors have been getting increasingly worried about the impact of tariffs and what they could mean for inflation and the economy overall. On Friday, the University of Michigan’s consumer sentiment survey dropped in March to its lowest level since November 2022. The one-year outlook for inflation part of the survey jumped to its highest level since November 2022. Earlier in the week, a pair of inflation reports for February — the consumer price index and the producer price index — came in lighter than expected. No Club holdings report earnings this week, but there are still plenty of things on our radar. 1. The big event of the week is the Federal Reserve’s two-day policy meeting, which wraps up Wednesday. It’s widely expected that the Fed will keep interest rates unchanged at 4.25% to 4.5%, so the real intrigue is around the central bankers’ Summary of Economic Projections (SEP) — home to the so-called dot plot of rate expectations — and Fed Chair Jerome Powell’s press conference at 2:30 p.m. ET on Wednesday. The SEP, which is updated four times a year, also includes projections for inflation and economic growth. With all the economic and inflation concerns hurting the market lately, there will be a lot of interest in what the Fed says this time around. In December, the dot plot implied just two quarter-point rate cuts in 2025, below market expectations, leading to a dramatic sell-off that day. The market is currently pricing in three cuts this year. Powell’s press conference takes on even greater weight due to all the economic uncertainty. Investors want to hear how Powell and policymakers are processing the evolving situation and what tariffs could mean for inflation and the economy. Last week, Powell said he wanted to see “greater clarity” on Trump’s policies before lowering interest rates again. 2. We’ll get a trio of economic reports of note in the days leading up to Powell’s news conference. The first is February retail sales on Monday morning. The data, released by the Census Bureau, will offer a look at how Americans spent their money during a month in which consumer confidence was softening amid tariff uncertainty. Inclement weather also likely impacted spending. In general, a number of retailers and airlines have recently warned that they’re seeing cracks in demand , though executives at Club name Costco indicated recently they haven’t seen much of a change in spending behavior. Then on Tuesday morning, we’ll get the Census Bureau’s latest look at residential construction data — often called housing starts — and the Fed’s read on industrial production and capacity utilization, a reflection on U.S. manufacturing health. On housing starts, in particular, we like to see more supply coming online because over time it should help address the country’s housing shortage, which has contributed to the sticky shelter inflation. On the other side of the Fed meeting, we’ll get initial jobless claims from the Labor Department and February existing home sales from the National Association of Realtors on Thursday. Club name Home Depot benefits from an increase in housing turnover, so the home sales data is relevant to our thesis. 3. On Tuesday afternoon, Nvidia CEO Jensen Huang is set to give his annual keynote address at the AI chip king’s influential GTC conference in San Jose, California. Jim Cramer will be at the conference. Shares of Nvidia have been beaten up this year but started to mount a rally in recent days. We expect to get details about two important Nvidia products during Huang’s presentation: Blackwell Ultra, an updated version of the company’s new AI chip platform that should roll out in the fall, and Vera Rubin, the successor to Blackwell targeted for a launch in 2026. “The keynote is very important. … You’ve got to reestablish that it’s actually a company that is a factory for the future,” Jim said during the Club’s Morning Meeting on Friday. 4. There’s no proxy fight to be resolved at Disney’s annual shareholder meeting this year, but there’s still plenty we would like to hear about on Thursday. Typically, the meetings will go over shareholder proposals and prepared remarks from CEO Bob Iger before he fields questions from investors near the end. We’ll be listening for any updates on succession planning, the launch of the standalone ESPN streaming offering this fall, and where the theme parks stand with new competition in Florida and growing consumer uncertainty. Of course, there’s no guarantee that any or all of these will be asked, but these are important debates around the stock, which we bought more of on March 10. Week ahead Monday, March 17 Retail sales at 8:30 a.m. ET Before the bell: Diversified Energy Company (DEC), Townsquare Media (TSQ) After the close: Getty Images (GETY) Tuesday, March 18 Housing starts at 8:30 a.m. ET Industrial production and capacity utilization at 9:15 a.m. ET Jensen Huang keynote at Nvidia’s GTC conference at 1 p.m. ET Before the bell: Sundial Growers (SNDL), Bitcoin Depot (BTM), Tencent Music Entertainment (TME) After the close: StoneCo (STNE), ZTO Express (ZTO) Wednesday, March 19 Federal Reserve interest rate decision at 2 p.m. ET Fed Chair Jerome Powell’s press conference at 2:30 p.m. ET Before the bell: Signet Jewelers (SIG), General Mills, Inc. (GIS), Ollie’s Bargain Outlet (OLLI), Sportradar Group AG (SRAD), Hutchinson China MediTech (HCM) After the close: Five Below (FIVE), North American Construction (NOA), Worthington Steel (WS) Thursday, March 20 Initial jobless claims at 8:30 a.m. ET Existing home sales at 10 a.m. ET Before the bell: Pinduoduo Inc. (PDD), Jabil Inc. (JBL), Academy Sports and Outdoor (ASO), Accenture Ltd. (ACN), Darden Restaurants (DRI), Designer Brands Inc. (DBI), FactSet Research Systems (FDS), Lands’ End, Inc (LE), Shoe Carnival, Inc. (SCVL), (ZK), Arthur J. Gallagher & Co. (AJG) After the bell: Micron Technology (MU), Nike Inc (NKE), FedEx (FDX), Lennar (LEN), KinderCare Learning Company (KLC), Scholastic (SCHL) Friday, March 21 Before the bell: Nio Inc. (NIO), Carnival Corp. (CCL) (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.